Value-Added Services That You Are Likely To Procure Through Best Enterprise Payment Gateway

If you have been an e-commerce store owner, you know the importance of proper user interface and its matching functionalities within your app or website. However, if the payment experience is not up to the mark, you are likely to lose a lot of prospective clients then. With passing time, the customers won’t trust you any longer, and you can see a drop in the sales and customer engagement.

Payment gateways play major role in the current customer buying experience. A proper gateway needs to be fast, smooth, secure and even trustworthy, to say a few. The proper gateway will always ensure confidentiality and security of customer and will leave a good impression. One functional payment gateway will allow the merchants to accept various transaction facilities securely on website and mobile app. Some of those are credit cards, debit cards, wallets and more.

Set up in right manner:

Always remember that one payment gateway in e-commerce store must be set up in proper manner. If the functions are not met properly, the business will suffer from the unwanted cart abandonment. It works like that because of the major payment gateway issues. If proper steps are not taken right, on time, it can lead to loss of sales and customers in the end. With the help of functional payment gateway, you can set up various payment options with trustworthy symbols and security certificates for long term success of online store.

How does it actually work?

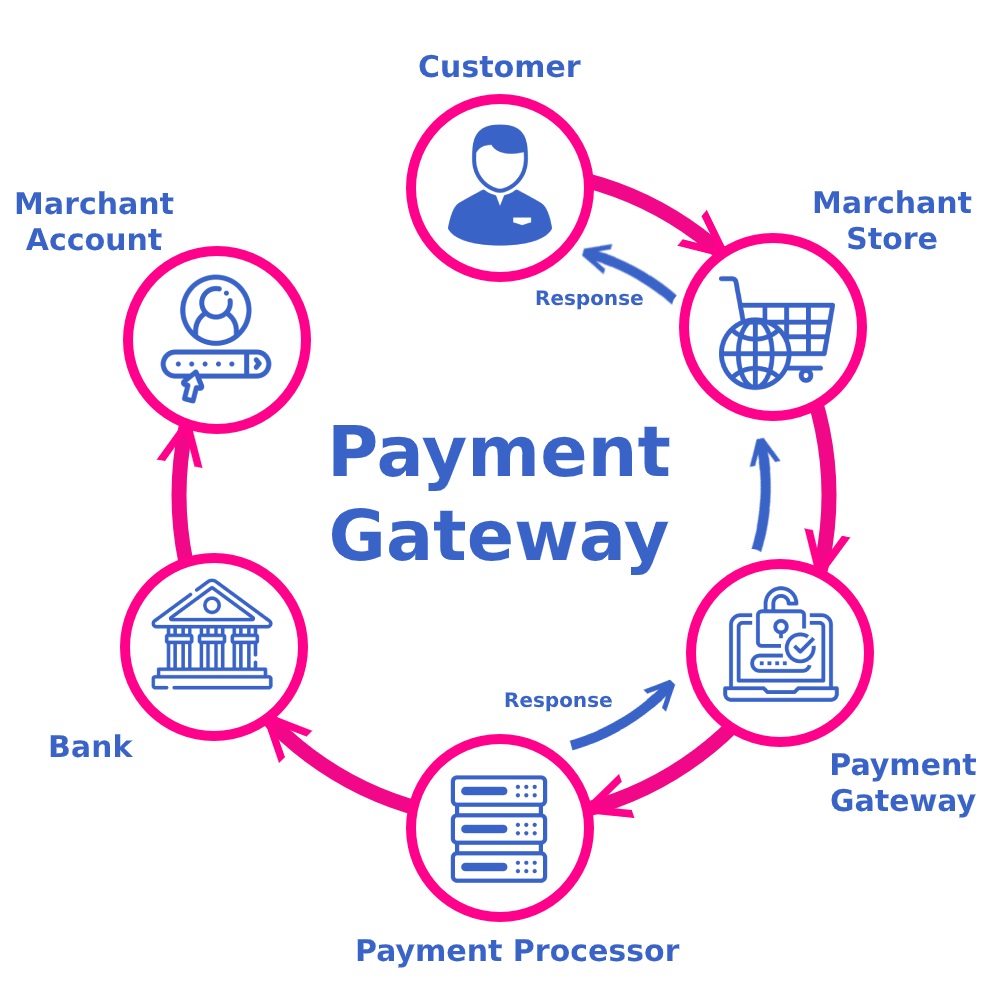

Customers will add services or products to cart that they are making plans to buy. Later, they will proceed further for making the payments. Later, the customers will be asked to offer details of their debit or credit cards. Such details will incorporate the cardholder name, 16 digits card number, expiration date and the most important, CVV number.

- Once the information has been submitted, it will be securely passed to the payment gateway depending on the integration type. It can be payment page integration, server to server, or even client side encryption.

- Later, it is time for the payment gateway to encrypt the details of the card and then focus towards a security check before you get to send card information to needed bank.

- Later, the acquiring banks are subject to send information to card schemes securely. Some of those options are Maestro card, Mastercard, Visa and more.

- The main goal of this card scheme is to procure an extra form of security check before sending payment information to the targeted bank. Once the fraud check and security has been performed, the issuing banks will then authorize the transactions.

- The current decline or approval message is then sent back to bank from any card schemes, and later to acquirer. It is then time for the acquiring banks to send approval or even any decline message to the payment gateway who will then send the message to merchant.

- In case the payment becomes successful, acquirer can then collect payment amount from issued bank and holds fund in merchant account. Depending on the message from the current gateways, the merchant can either display the order or payment confirmation page.

- The main goal over here is to ask customers to retry some of the other payment methods. The best gateway will offer smoother transactions. This process takes place in real time and in background, and the entire process takes less than just 3 seconds to complete.

The hardcore benefits you cannot ignore:

Before you head towards the best enterprise payment gateway, the time has come to focus on the benefits of such payment gateways to follow. The perfect online payment modules will ultimately improve the entire performance level of your business.

- You will enjoy that easy checkout with such gateways. The seamless and swift checkout experiences are one major need for a customer. The payment gateways will enable such features to make online shopping a lot easier.

- Then you have impulse purchase as another note. It has been stated that over 40% of the customers will cancel their purchase in case the payment or checkout method is complex or rather tedious. But, as per some of the studies, it has been found out that impulse purchase is well responsible for 40% of online purchases. So, an easy payment option will increase sales.

- Payment gateways will also add well with shopping cart and offer faster payment processing. It is here to accept multiple paying options and will offer that charge back prevention.

- Proper secure payment gateway will keep fraud accidents at bay with its ultimate fraud management services. It also offers recurring billing as another major benefit.

You can always complaint payment gateways with security standards such as PCI DSS. So, now procuring secured transactions every time won’t be a tough nut to crack.