Pradhan Mantri Awas Yojana for Home Loan – Know Everything About PMAY Scheme

The Central Government of India launched the Pradhan Mantri Awas Yojana in 2015 in its bid to make affordable housing a reality for all and offer ‘Housing for all’ by 2022.

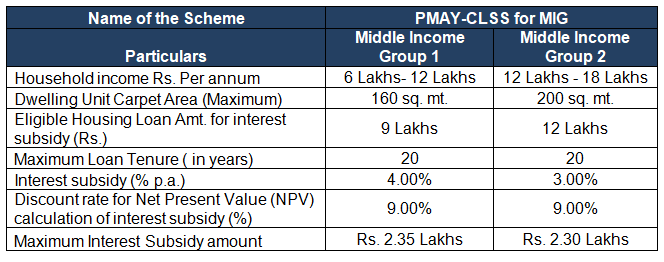

The Pradhan Mantri Awas Yojana (PMAY) scheme has extended its scope to cater to the housing demands of the middle-income groups along with low-income and economically weaker sections, such as MIG-I and MIG-II sections of the society.

What is PMAY?

The Government wants everyone to have a home by 2022 and to provide affordable housing solutions to all, the scheme was rolled out in June 2015. It has plans to build environment-friendly homes (pucca homes) in many urban and rural areas.

If you fail to find your name in the list of people applying to move into a home built by the Government, you can also avail a home loan and enjoy benefits on it.

Yes, one can also apply for the Pradhan Mantri Awas Yojana home loan and avail the credit-linked interest subsidy as per one’s income level.

What’s covered under the PMAY?

The scheme covers people in the economically weaker section with annual income not more than Rs.3 lakh, and low-income group with an income of up to Rs.6 lakh. It also covers the mid-range or the middle-income groups with an income up to Rs.12 lakh and Rs.18 lakh respectively.

Who are the beneficiaries of the scheme?

The immediate beneficiaries of the Pradhan Mantri Awas Yojana will be:

- A beneficiary family shall be made of husband, wife, and unmarried children (sons and daughters)

- An earning member who is an adult could be considered as a distinct household, his/her current marital status notwithstanding

What is the importance of the Pradhan Mantri Awas Yojana?

As you read this, the real estate developers in key Indian metropolis sit on endless homes costing Rs.50 lakh and more, the country is estimated to have a clear shortage of more than 20 million homes required by urban and rural poor between Rs.5-15 lakh.

The Pradhan Mantri Awas Yojanarises on the time to address this issue. With the subsidized loan amount increased up to Rs.12 lakh, the plan can cover a majority of the urban poor.

Also, the Pradhan Mantri Awas Yojana is also pegged to incentivize the real estate sector to lessen its conventional obsession with only well-off home buyers in cities.