6 Best Ways to Earn Passive Income from Crypto in 2020

There should be no denying that cryptocurrencies are an incredibly important part of the contemporary financial landscape. One of the most cited reasons behind this popularity lies in the simple fact that these digital assets still offer an unprecedented level of anonymity and versatility that both make an incredibly fortunate match with the current globalized economy.

However, over the last couple of years, cryptocurrencies started to find a completely new role in the business world. Namely, as time goes by, more and more businesses of all sizes have started to invest in crypto mining as a way of generating passive income. How does this process work, and how can it benefit your business? Let us try to find out.

Start hoarding the coins

And we mean exactly that – good, old dragon-style hoarding. Even if we take into account all the price fluctuations, we can see that, historically, the value of digital currencies tends to grow as time goes by. Also, their volume is limited. For instance, no matter what happens, there will be only 21 million bitcoins in circulation. That makes bitcoins and similar currencies incredibly valuable assets more than worth stacking up. However, you have to remember that not all coins have good fundamentals so you should do a bit of research before spending your money.

Earning by lending

Lending is the concept as old as the currencies themselves (probably even older). Because of that, it shouldn’t come off as too big of a surprise that crypto coins lend themselves surprisingly well to this concept. As a matter of fact, the speed and anonymity in which transactions are made allow you to avoid bothersome legal instances and get the freedom you couldn’t possibly get with the traditional assets. But, in order to get enough coins to engage in a full-scale lending business, you need to establish a constant influx.

Engage in cryptocurrency stacking

On first glance, stacking is not that different from hoarding – both these activities involve acquiring ample amounts of digital coins. However, in the case of stacking, you will be buying and keeping your crypto coins in special wallets and earning the regular dividends. This may sound too easy, but since you are contributing to the security of the blockchain, the stacking rewards (the rewards paid in native currency) sometimes go up to 6%. Even better, as the popularity of some currency rises, the rewards tend to go even higher.

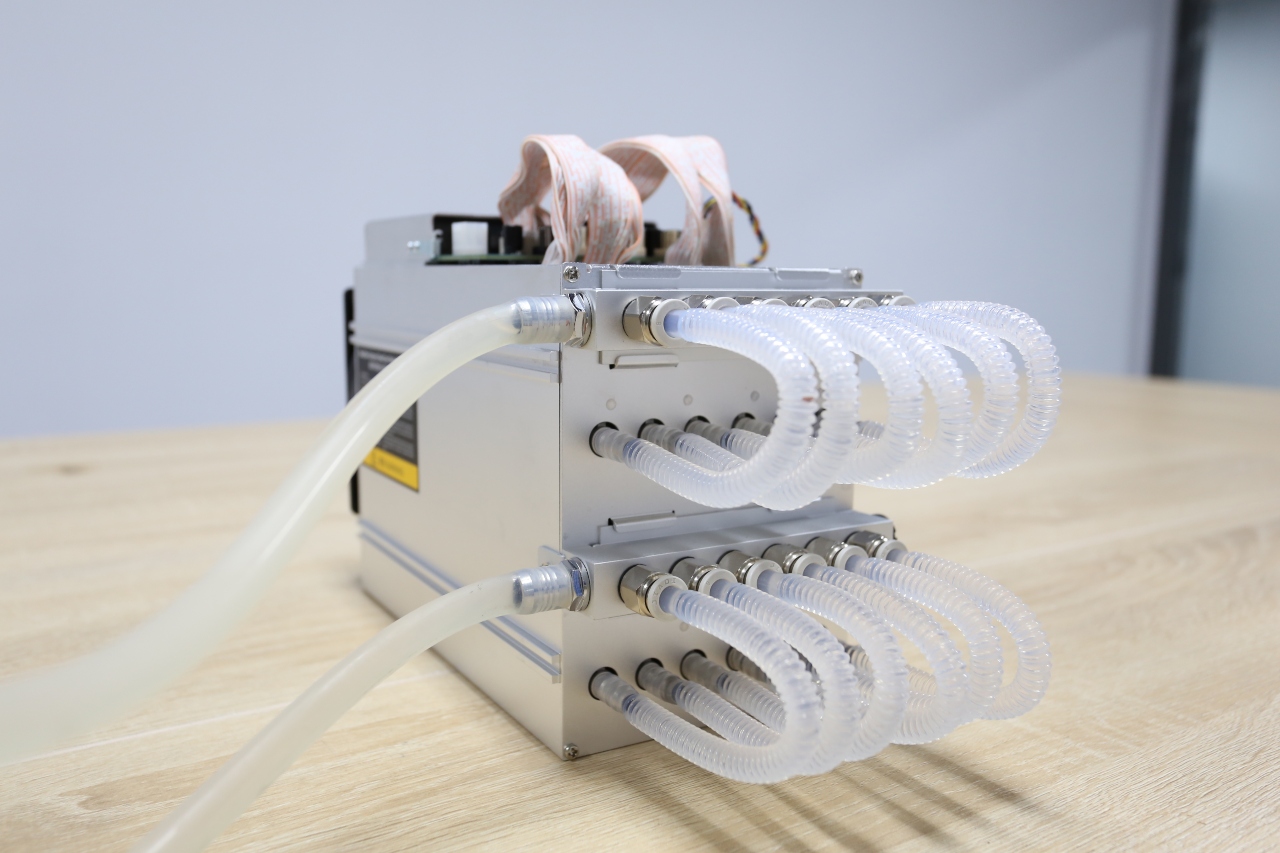

Set up your mining farm

That brings us the next topic. Although a skilled trader can secure an ample amount of digital currencies, crypto mining remains the only viable way of securing the constant influx of coins. However, you have to keep in mind that the mining landscape has become incredibly competitive, so if you want to earn serious money, you will need to invest in professional units like ASIC miner. But no need to worry, while full-scale mining farms may require a noticeable up-front investment, they do produce sustainable revenue in the long run.

Go all AI with trading bots

We have already mentioned that trading digital coins requires a lot of time and skill. Well, this task can be made considerably simpler if you use some of the automated crypto trading bots like for instance Gunbot. The products like this use proven trading strategies and leave emotions out of the equation so they ought to produce good results. Be warned, however, that you will still have to spend countless hours fine-tuning your settings and researching the market. But, it is an effort well-rewarded.

Explore the possibilities of margin funding

Finally, we have to mention margin funding – the process in which you lend out your cryptos to margin traders so they can opt for long or short positions. This may sound like a fairly tricky move, and to be quite honest, you should do extensive research before depositing your money, but some of the share investment pools like for instance OKEx have proved to be quite reliable as of lately. So, as long as you set your priorities straight and know what you are doing, you will be able to earn more than ample passive income.

We hope these six ways to earn passive income from cryptocurrencies managed to cast some light on the value of these digital assets. The year 2020 has proved to be quite turbulent up until now, and we have no reason to believe the things are going to change in the following months. With the things as they are finding new income flows and expanding your investment portfolio only seems like a good idea.